February 19, 2013

We’ve written more than one blog post recently on the changes to the FHA mortgage insurance policy. Because of the potential for confusion over these changes, we’re attempting to explain these changes one important detail at a time.

When the FHA announced its changes and made them official, it issued a mortgagee letter which includes the following information:

“For loans with FHA case numbers assigned on or after June 3, 2013, FHA will collect the annual MIP for the maximum duration permitted under statute. For all mortgages regardless of their amortization terms, any mortgage involving an original principal obligation (excluding financed Up-Front MIP (UFMIP)) less than or equal to 90 percent LTV, the annual MIP will be assessed until the end of the mortgage term or for the first 11 years of the mortgage term, whichever occurs first.

For any mortgage involving an original principal obligation (excluding financed UFMIP) with an LTV greater than 90 percent, FHA will assess the annual MIP until the end of the mortgage term or for the first 30 years of the term, whichever occurs first.”

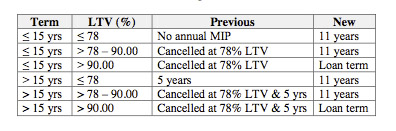

To help borrowers better understand these changes, the FHA also published a table that shows the old MIP versus the new MIP, which takes effect for all FHA loans as described above with case numbers assigned on June 3 2013 and beyond.

Here’s that table:

As we’ve reported before, the new FHA MIP terms are not changing for any FHA loan with case numbers assigned prior to the date mentioned above. The FHA is not changing any current borrower’s MIP terms, only requiring a new term for the loans with case numbers assigned on or after June 3 2013.

We re-emphasize this to reassure our readers and to clear up any confusion that may surround this issue. For more information on this issue, contact the FHA directly by calling 1-800 CALL FHA.

Do you have questions about FHA loans or refinance loans? Ask us in the comments section.