May 11, 2020

Buying A House In The Era Of COVID-19

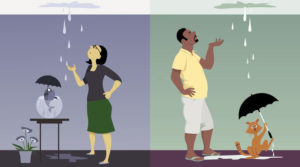

Who buys a house during a global pandemic? The answer to that question may surprise you at first, but a quick look at the official site for the Department of Housing and Urban Development and it’s clear that there’s a demand, and with good reason. Some Americans not only consider buying or renting a new home during COVID-19, but some actually have no choice but to seek new housing. This could be due to any number of factors including illegal evictions, loss of income, job changes that require relocation, natural disasters, changes in family size, changes in marital status, many reasons. And those people create a demand that must be met, even during a national emergency. Granted, not all home loans during this time are out of necessity, but the | more...