October 31, 2017

In a recent blog post we discussed income requirements for an FHA loan including basic debt-to-income (DTI) ratio issues, the fact that your income must be stable and reliable, and that you can’t earn “too much” to qualify for an FHA mortgage.

One question some FHA loan applicants have at this point involves how the lender arrives at things like the debt to income calculation, how job reliability is determined, etc.

How Does The Lender Calculate My Debt To Income Ratio For An FHA Home Loan?

Simply put, the loan application will ask. You will have places in your application which ask about your monthly obligations, and the lender will also check your credit reports to see what active accounts you have. Some borrowers may be tempted to omit certain things from a loan application thinking what the lender does not know won’t be revealed elsewhere, but this is not true.

Furthermore, FHA loan rules instruct the lender on how to proceed when an undisclosed debt turns up in the borrower’s credit history or elsewhere. It’s not a good idea to deliberately omit information from your application since your lender will likely find that data elsewhere.

The Debt To Income Ratios

As the headline above implies, there are actually TWO debt-to-income ratio calculations your lender is required to make. One is the basic amount of income you have compared to the amount of current debt you owe on a monthly recurring basis. The second DTI calculation is made using your income, current debt, and also the projected amount of a monthly mortgage payment.

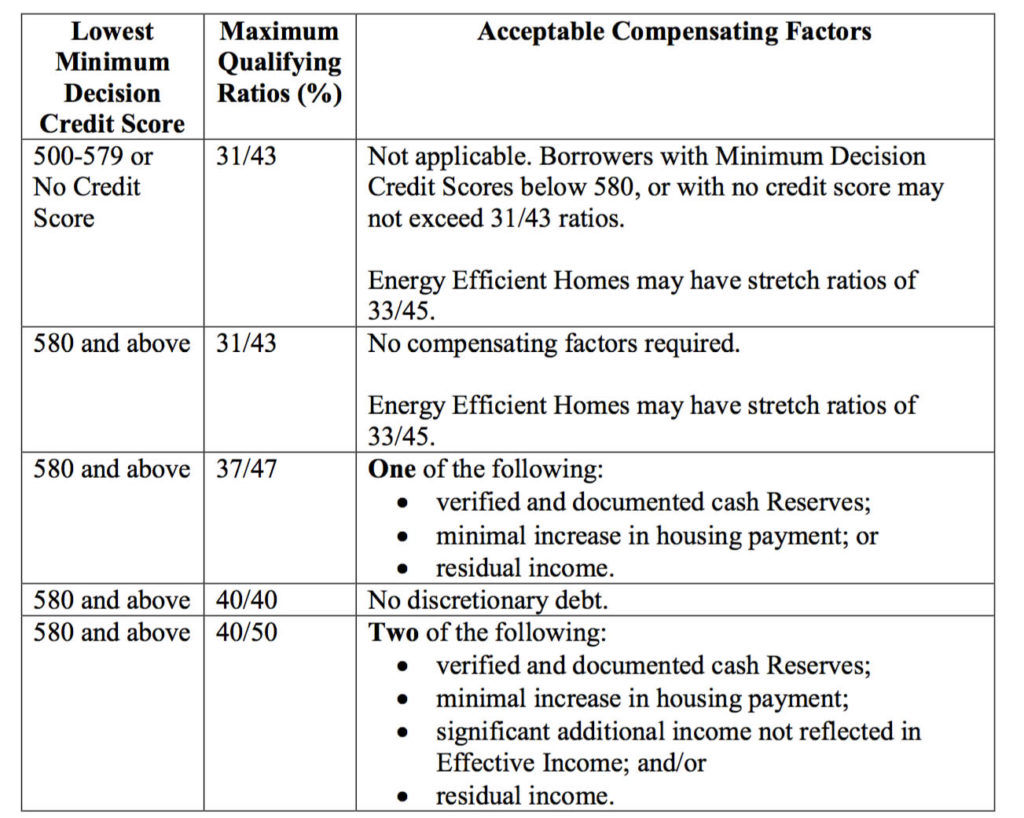

These two ratios are compared and there is a specific “matrix” for them which indicates when some type of compensating factor may be required in order to approve the loan. These compensating factors are required when the debt ratio is too high, and more income is taken up by debt than the percentage needed to approve the loan without such factors.

Here is the list of those ratios and compensating factors as found in HUD 4000.1. Additional lender standards may apply:

Remember that the two numbers you see in the Maximum Qualifying Ratios column refer to the percentage of debt and monthly obligations without the mortgage, followed by the same percentage of monthly income taken up by debt INCLUDING the monthly mortgage. The second number is the “with mortgage” ratio.

As you can see, FICO scores and debt ratios together equal a very important part of the lender’s decision to approve or deny the loan.

FHA loan debt-to-income ratio minimums aren’t the only standard-your chosen financial institution will also have minimums that must be met, so it is important to have a conversation with a loan officer to determine what is possible with that lender.