March 7, 2014

Recently we wrote about the requirements for FHA streamline refinance loans to have a “net tangible benefit” to the borrower. The type of benefits mentioned in the FHA loan rulebook for streamline loans (in general) include a lower interest rate and/or monthly payment for the borrower.

The purpose of an FHA streamline refinance loan is to help a home owner with an existing FHA mortgage get into a more affordable mortgage loan payment without an FHA required credit check or appraisal. (The lender may require one anyway.)

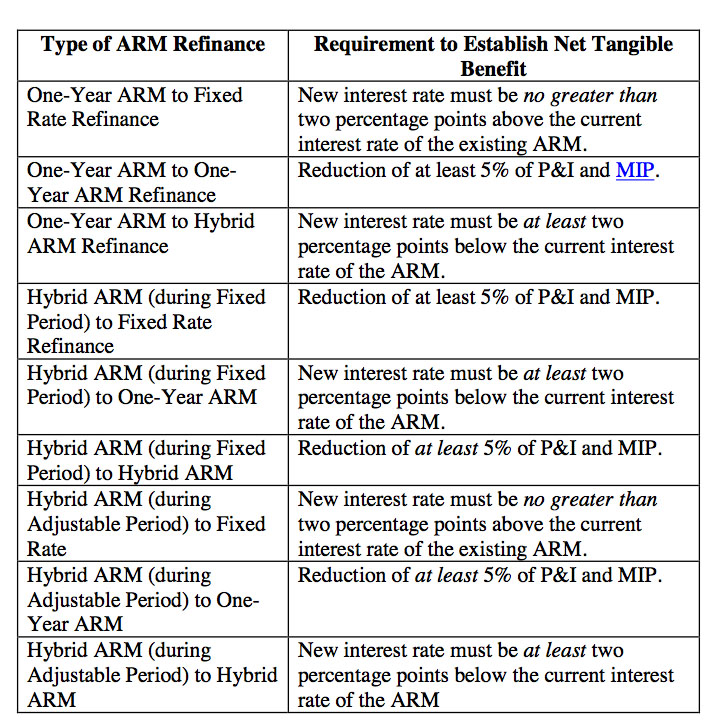

Since there are many different types of FHA loans available, the net tangible benefit for the borrower may be different depending on the kind of loan being refinanced. The FHA has a table showing all the requirements for the different types of loans (fixed rate, graduated payment mortgage, adjustable rate mortgages, etc.) and what the benefit to the borrower must be in most cases for FHA loan approval.

This table is found in HUD 4155.1 Chapter Six Section Five and has the following information:

Speak to a loan officer for more information on the type of loan you’d like to refinance with an FHA streamline mortgage for more information on any of the transactions listed above.

Speak to a loan officer for more information on the type of loan you’d like to refinance with an FHA streamline mortgage for more information on any of the transactions listed above.

Do you have questions about FHA home loans? Ask us in the comments section. You can apply or get pre-approved for an FHA loan at FHA.com, a private company and not a government website.