April 29, 2015

A reader asks, “If I need to refinance to remove my ex-husband from my mortgage loan, and he has already signed the quit-claim and put the mortgage in my name only. Do I have to meet the normal 5% payment reduction requirement for the Net Tangible Benefit?”

A reader asks, “If I need to refinance to remove my ex-husband from my mortgage loan, and he has already signed the quit-claim and put the mortgage in my name only. Do I have to meet the normal 5% payment reduction requirement for the Net Tangible Benefit?”

The borrower does not specify whether the refinance loan is an FHA Streamline Refinance loan or a cash out loan, but since this comment was on a post we did on FHA Streamline refinance loans, we’ll assume that’s the loan being asked about.

FHA Streamline loans do require a “net tangible benefit” to the borrower as described in HUD 4155.1. That benefit could be a lower monthly payment, lower interest rates, or the fact that the borrower is refinancing from an Adjustable Rate Mortgage to a fixed rate loan.

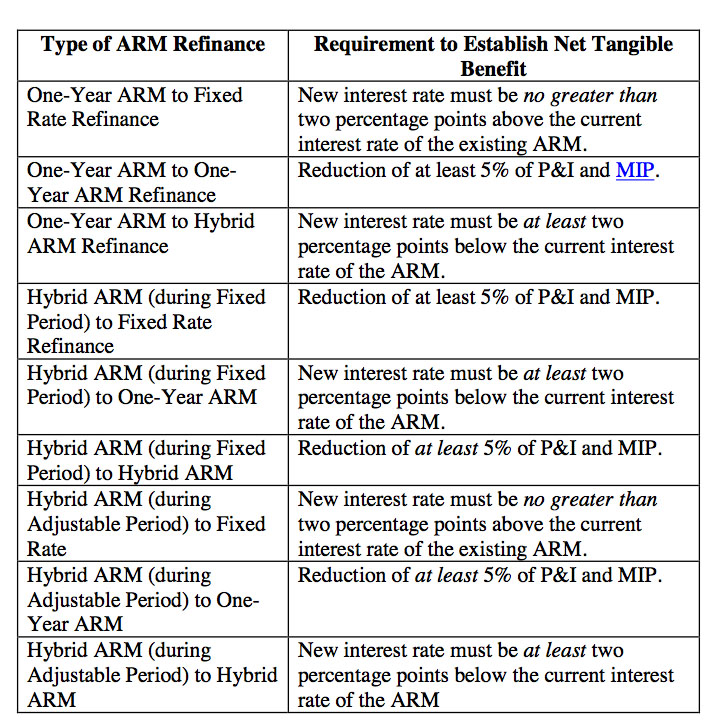

However, depending on the type of loan refinanced, the FHA’s opinion of what a net tangible benefit is may vary. the net tangible benefit for the borrower may be different depending on the kind of loan being refinanced. HUD 4155.1 Chapter Six features a table showing the net tangible benefit requirements for the different types of loans including fixed rate, graduated payment mortgage, adjustable rate mortgages, etc.

The table breaks down, per type of loan, what the benefit to the borrower must be in most cases for FHA loan approval for a Streamline Refinance Loan. Here is that table as found in HUD 4155.1 Chapter Six:

Borrowers should know that based on a reading of the Streamline Refinance Loan program rules, refinancing to take someone off the mortgage is not in itself considered a qualifying net tangible benefit. Nor is refinancing simply to get a reduction in the loan term. Speak to your loan officer about your needs for refinancing to see what type of loan might be best for you. In some cases a Streamline Loan may be the best option, in others a cash out or no-cash-out refinance loan might be more suitable.

Do you have questions about FHA home loans? Ask us in the comments section.