April 30, 2012

One commonly asked question about FHA home loans involves the process of determining how much a borrower could pay on a monthly basis on the FHA guaranteed loan.

For this purpose, the FHA official site refers potential borrowers to a loan calculator provided by GinnieMae.gov, which is designed to help borrowers get a general idea of what the costs might be per month based on user-provided details including the sale price of the home, the housing market that home is in, etc.

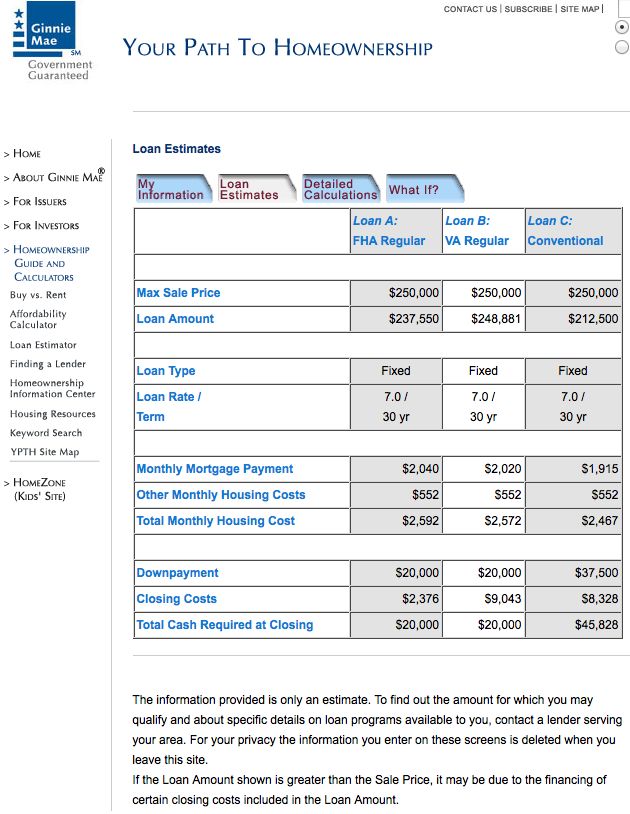

Specifically, the loan calculator asks for the sale price of the property, the state and county where that property is, the term of the loan plus interest rate, and the amount of down payment. Once these fields are filled in, the GinnieMae.gov calculator returns the results with plenty of details, as you’ll see in this sample (provided for general information purposes only, which does not represent any actual costs for a real-world FHA home loan):

Obviously the Ginnie Mae loan calculator, which is available here at GinnieMae.gov, requires a borrower to have a sale price, interest rate, and other factors in order to use it properly.

But if you have a basic idea of what typical interest rates for your housing market might be, plus the price range of the home you want to buy plus a proposed down payment amount, you can get a decent idea of what the loan might cost you in general.

These calculations naturally don’t include options–for example, if you finance interest rate discount points, certain closing costs or add energy efficient improvements to the loan amount. Discuss such options with your lender for more details on what typical costs might be for such added expenses.