January 24, 2015

A reader asks, “What are the credit score and requirements to qualify for a FHA loan? Also, we filed bankruptcy over a year ago, what are the time limits of being discharged before someone can qualify for a FHA loan? Thank you in advance.”

FHA loan rules for FICO score minimums are included on the FHA official site at www.FHA.gov.

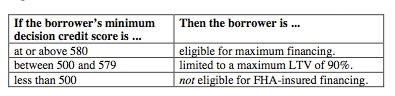

There is a chart there that breaks down the required minimum FICO scores for minimum financing, basic FHA loan program eligibility (with a higher down payment due to lower FICO scores) and cases where the FICO score does not qualify for an FHA home loan. Here is that chart:

Note that FHA FICO score requirements are MINIMUMS. The lender may have higher standards. In fact, borrowers may find many lenders are looking for FICO scores at or above between 620 and 640 depending on the financial institution.

It’s best to contact the FHA/HUD directly to ask for a referral to a HUD approved pre-purchase housing counselor who can help with credit questions like these prior to applying for a new FHA loan.

The bankruptcy question depends greatly on circumstances. Was the filing Chapter 7? Chapter 13? How is the borrower’s credit activity post-bankruptcy? There are many variables that can affect whether a new loan is possible or not. You can learn a great deal on FHA loans after bankruptcy by reading this article.

Do you have questions about FHA home loans? Ask your question in our comments section.