January 7, 2015

Many FHA loan applicants want to know what the FHA loan minimum FICO score requirements are, but did you know that FHA loan standards are only part of the equation? The lender will also have minimum FICO scores as a requirement–these minimums may match the FHA standards or exceed it. In many cases a borrower will find the lender has more stringent standards than the FHA.

Many FHA loan applicants want to know what the FHA loan minimum FICO score requirements are, but did you know that FHA loan standards are only part of the equation? The lender will also have minimum FICO scores as a requirement–these minimums may match the FHA standards or exceed it. In many cases a borrower will find the lender has more stringent standards than the FHA.

What are the FHA minimum FICO score requirements? The rules for FICO scores on FHA new purchase home loans and refinance of those loans can be found in HUD 4155.1, which gives instructions to lenders on how to process FHA loans.

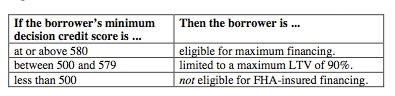

That table above is reprinted from HUD 4155.1, and as you can see, FICO scores of 580 and above are technically eligible for FHA loans at the maximum financing possible.

That maximum financing still requires a minimum down payment from the borrower, and there’s no such thing as a zero down payment FHA home loan. Borrowers should come to the FHA loan process ready to make a down payment on a new purchase mortgage.

Lender standards often exceed the minimums you’ll see listed in that table above. FICO scores of 620 or higher are commonly required, and you may find lenders with a FICO score of 640 or better as a minimum requirement.

Some lenders may be willing to work with you if you bring compensating factors to the table–a borrower with lower FICO scores may, for example, be able to get a lender to approve the loan with a higher interest rate or increased down payment.

Lenders and borrowers work together all the time in such cases–individual circumstances play a great part in loan approval depending on those circumstances. Don’t assume you can’t qualify for an FHA home loan before discussing your situation with a loan officer. You may have options you don’t realize exist.

Do you have questions about FHA home loans? Ask us in the comments section. You can also follow us on Facebook.