May 7, 2013

A reader asks, “My home has more than 50% equity and I am thinking about refinancing with an FHA loan… will i still need mortgage insuranc3e for the life of the loan.. or can it be cancelled after verification of equity?”

FHA loan rules for annual mortgage insurance premiums are changing. Some of the rules have already taken effect, and others go into effect on June 3 2013. FHA Mortgagee Letter 2013-04 says:

“For loans with FHA case numbers assigned on or after June 3, 2013, FHA will collect the annual MIP for the maximum duration permitted under statute.” Additionally, “For all mortgages regardless of their amortization terms, any mortgage involving an original principal obligation (excluding financed Up-Front MIP (UFMIP)) less than or equal to 90 percent LTV, the annual MIP will be assessed until the end of the mortgage term or for the first 11 years of the mortgage term, whichever occurs first.”

“For any mortgage involving an original principal obligation (excluding financed UFMIP) with an LTV greater than 90 percent, FHA will assess the annual MIP until the end of the mortgage term or for the first 30 years of the term, whichever occurs first.”

These changes are effective for “all forward mortgages except single family forward streamline refinance transactions that refinance existing FHA loans that were endorsed on or before May 31, 2009”.

The reader doesn’t specify which type of FHA refinance loan might be used, so it’s difficult to answer the question except in general terms as stated above–ALL forward mortgages except the previously mentioned FHA streamline refinance loans refinancing mortgages endorsed on or before May 31 2009 would be affected by the rule changes which take effect on June 3 2013. For more details, contact the FHA directly at 1-800 CALL FHA.

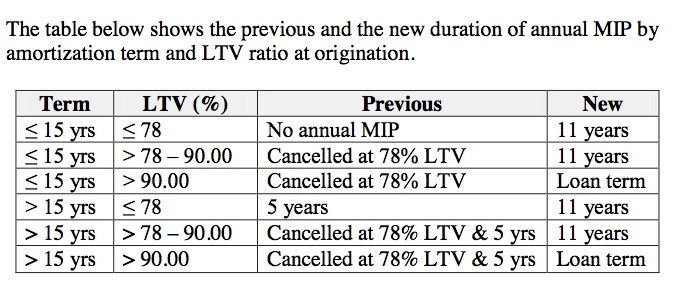

Here’s the FHA loan table used to illustrate how loans are affected by the new Annual Mortgage Insurance Premiums:

Do you have questions about FHA home loans? Ask us in the comments section.