June 20, 2013

A reader asks, “Do all three credit scores on my credit report have to be in the 640 range in order to qualify for an FHA home loan?”

A reader asks, “Do all three credit scores on my credit report have to be in the 640 range in order to qualify for an FHA home loan?”

FHA loan rules include a minimum credit score. Borrowers who have credit scores below this minimum are not eligible for FHA loan financing. But the minimums found in the FHA loan rules are not necessarily the minimums a financial institution will impose–and the bank is free to require a general higher standard applied equally to all borrowers according to Fair Housing laws.

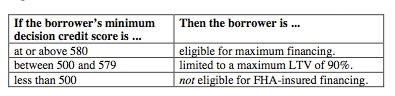

FHA loan FICO score minimums are as follows, as found on the FHA official site:

However, many lenders will require a minimum credit score of 640. The reader wants to know if all his or her credit scores need to be in the 640 range in order to apply. According to FHA loan rules as found in HUD 4155.1, Chapter Four Section A:

“If a credit score is available, it must be used to determine the decision credit score for the application and for eligibility for FHA-insured mortgage financing. A “decision credit score” is determined for each applicant according to the following rule: when three scores are available (one from each repository), the median (middle) value is used; when only two are available, the lesser of the two is chosen; when only one is available that score is used.”

It’s best to try to bring your credit scores as close to 640 as possible if you fall below that number as it seems to be the prevailing credit minimum for home loans of this type.

Again, the minimums you find in the FHA table above are just that–FHA minimums. There is no law or regulation forcing lenders to accept loan applications with these FICO scores. For more information on the issue of FHA minimums versus lender FICO score minimums, contact the FHA directly at 1-800 CALL FHA or speak to a loan officer.

Do you have questions about FHA home loans? Ask us in the comments section.