October 9, 2012

A reader asks, “I have really been working on my credit to be able to purchase a home. My scores are 618 – 595 – 540. I paid my student loan off in full. I went and got a unsecured credit card to help boost my scores…when people check your credit the numbers roll back…I have an auto loan for just over a year that is in good standing.”

“I also paid off 2 vehicles and have been at my job now for just over 16yrs….Why, Why, Why couldn’t I qualify for this loan?”

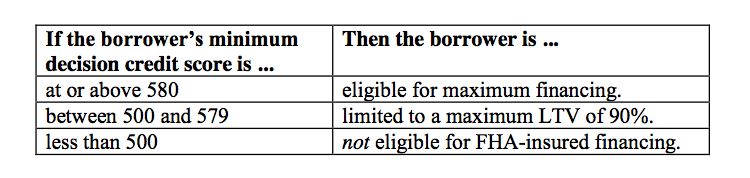

There are a number of reasons why a borrower might not be approved for an FHA mortgage, but in this reader’s case the FICO score could be one of those reasons. Why? According to FHA loan rules, as stated in HUD 4155.1, the reader’s scores do technically meet FHA minimums:

However, FHA loan minimum requirements aren’t the only factors at work in the decision to approve or deny an FHA loan. The lender’s minimum credit requirements for FICO scores are often higher than these minimums.