January 15, 2015

A reader asks, “When calculating the annual PMI, are the bps assessed against the original loan amount or the current pay-off amount of the loan?”

A reader asks, “When calculating the annual PMI, are the bps assessed against the original loan amount or the current pay-off amount of the loan?”

Assuming the reader is asking about annual FHA Mortgage Insurance Premiums, and not monthly Private Mortgage Insurance, it’s important to know the following:

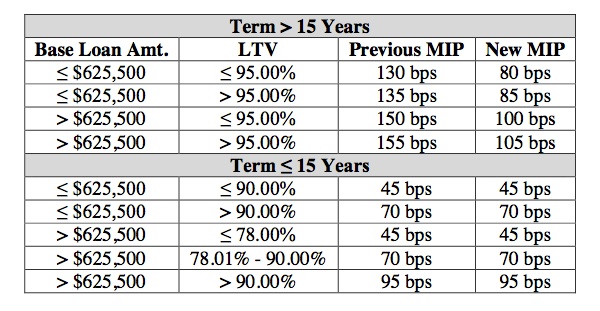

When the FHA and HUD announced a reduced annual Mortgage Insurance Premium, it created a table showing how the new Mortgage Insurance Premium (MIP) is calculated. FHA MIP is calculated, according to the FHA/HUD official site, by “amortization term, base loan amount and Loan to Value (LTV) ratio.” Here is the table published by the FHA showing the new FHA MIP rates:

As you can see, there is a listing for the previous FHA MIP payment and the new FHA MIP payment. This table is effective close to the end of the month, according to an FHA press release, which states, “New MIP amounts set forth in this table are effective for case numbers assigned on or after January 26, 2015.”

As you can see, there is a listing for the previous FHA MIP payment and the new FHA MIP payment. This table is effective close to the end of the month, according to an FHA press release, which states, “New MIP amounts set forth in this table are effective for case numbers assigned on or after January 26, 2015.”

Borrowers who might be on the margins of the effective date for the new MIP rules may be able to have a new FHA loan case number assigned.

According to a mortgagee letter (ML) published on the FHA official site, “To allow mortgagees to obtain the reduced annual MIP rates contained in this ML for loans in process with active FHA Case Numbers, FHA will temporarily approve cancellation requests for active FHA Case Numbers within 30 days of the effective date of this ML. FHA will provide operational details on case cancellations through FHA Info notifications and on FHA’s lender information page available at www.hud.gov/lenders.”

It should be noted that FHA Mortgage Insurance Premiums (MIP) are not the same as Private Mortgage Insurance (PMI). PMI is calculated as a percentage of the loan amount (minus the downpayment).

Do you have questions about FHA home loans? Ask us in the comments section. All comments are held for moderation.