June 30, 2014

A reader asks, “How low can a credit score be? i know mine is about 540. If it is for low income people with BAD credit why should the score matter at all?”

A reader asks, “How low can a credit score be? i know mine is about 540. If it is for low income people with BAD credit why should the score matter at all?”

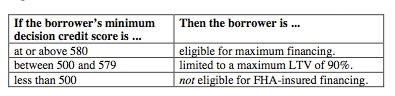

The FICO score question has two important aspects borrowers should be aware of. FHA loan rules establish a minimum FICO score requirement. HUD 4155.1 includes a chart to show the FICO minimums and how maximum financing is affected depending on what the borrower’s FICO score is within these ranges:

FHA minimum scores are just that–the minimum numbers required. Lenders can and often do have more strict FICO score rules than what you see printed above. There’s no such thing as a “bad credit FHA home loan”. Borrowers who do not meet the minimums listed above can’t be approved for an FHA home loan or can’t be approved for maximum financing depending on the circumstances as detailed in the chart.

A common misconception about the FHA loan program is that it is for first-time homebuyers, or that it is for low-income borrowers, or that FHA loans are ONLY for people who couldn’t afford the down payment on a conventional mortgage loan, or other variations on these themes.

The truth is, no minimum OR maximum income limits are established for FHA loans. FHA loans are simply an alternative to conventional loans with more forgiving terms written into the program by the FHA.

Borrowers are still required to credit-qualify for the loan and demonstrate they are a good credit risk. Hence the FICO score requirement and the scrutiny of debt-to-income ratios and other financial factors.

Do you have questions about FHA home loans? Ask us in the comments section. You can get information about applying or getting pre-approved for an FHA loan at FHA.com, a private company and not a government website.