December 2, 2013

A reader asks, “What if my credit score is below 600, but am now cleaning up my record so I can purchase a home. Not a pricey home but one I can retire in some day. I checked my credit report and some of the things on it are no longer a problem, and now paid, but they remain on it. I need to know as soon as possible because the small home I am interested in might be sold soon.”

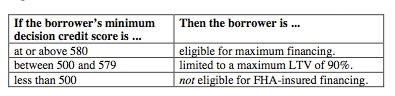

Let’s examine what the FHA loan rulebook (HUD 4155.1) says about minimum FHA requirements for credit scores:

This table is reproduced directly from HUD 4155.1. Note that the FHA minimum credit score requirements is 500 or above. But does this mean that a borrower with a FICO score of 500 (as the lowest number) is automatically eligible for an FHA mortgage loan?

Not necessarily. The lender’s credit score requirements also come into play. If the lender’s FICO score requirements are higher than this, whatever that lender’s minimums happen to be will be the requirement. The lender may allow for lower FICO scores in some cases if there are “compensating factors” which may include a larger down payment, but in the end, as long as the borrower meets both the FHA minimum FICO score and the lender’s, the process will likely continue as normal.

Every lender has different standards, which is why FHA loan applicants are encouraged to shop around for the lender who can offer the most advantageous rates and terms.

Another factor that should be mentioned in any question involving FICO scores is the question of missed or late payments. Borrowers should come to the FHA loan process with a minimum of 12 months of on-time bill paying on their record–anything less can jeopardize your chances at FHA loan approval.

On-time bill payment is an important indicator to the lender that the borrower could be considered a good credit risk. Borrowers who need to wait a few extra months in order to come to the bargaining table with the 12 months of reliably payment history often do well to wait the extra time and make sure their financial obligation history is as solid as possible before turning in the application for an FHA mortgage.

Do you have questions about FHA home loans? Ask us in the comments section. You can apply or get pre-approved for an FHA loan at www.FHA.com, a private company and not a government website.