December 12, 2013

A reader asks, “If my credit score is currently between 618 and 630 why can’t I qualify for a loan? Does it have to be 700?” The answer to this question may not be as simple as citing FHA loan policy on credit scores, but it’s a good place to begin.

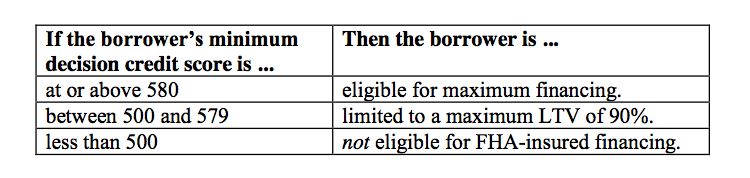

Credit score minimums, according to the FHA loan rules found in HUD 4155.1, are as follows:

These are MINIMUMS found in the FHA loan rulebook, and there’s nothing that says a lender cannot require a higher minimum score as long as those requirements are applied in accordance with Fair Housing Act laws. But credit scores alone don’t determine whether a borrower is eligible for an FHA home loan.

These are MINIMUMS found in the FHA loan rulebook, and there’s nothing that says a lender cannot require a higher minimum score as long as those requirements are applied in accordance with Fair Housing Act laws. But credit scores alone don’t determine whether a borrower is eligible for an FHA home loan.

Credit repayment history is also a factor. If a borrower comes to the FHA loan process with at least 12 months of on-time payments combined with a credit score that meets the participating FHA lender’s requirements, chances of FHA loan approval are much better. But if a borrower has missed payments or has a credit history that shows a pattern of late payments and/or other issues, FHA loan approval becomes less likely.

Debt-to-income ratios can also be an issue. A borrower who pays on time, has an acceptable FICO score, but has too much debt may also find it difficult to get FHA loan approval. The amount of the mortgage loan payment added to that ratio (which the lender will calculate as part of the debt-to-income ratio review process) could push the borrower’s ratio too high.

That’s not to say that this reader has any of these problems–it may be a case of trying to work with a lender who has a higher requirement when it comes to FICO scores. In any case, it’s good to know that the standards for FHA loan approval include all of these issues. Borrowers should anticipate and prepare for these areas to be scrutinized when applying for an FHA home loan.

Do you have questions about FHA home loans? Ask us in the comments section. You can apply or get pre-approved for an FHA loan at www.FHA.com, a private company and not a government website.