August 14, 2013

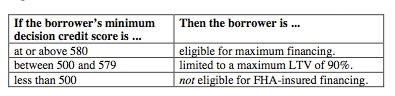

FHA loan rules include certain “automatic” rejections of an FHA loan application. For most typical borrowers these factors may not be an issue, but it is a question that arises from time to time: what circumstances force an automatic rejection of an FHA loan application? Here’s one example from the FHA loan rulebook, based on FHA FICO score requirements:

That table indicates that a borrower with a FICO score of less than 500 is not eligible for an FHA mortgage. But there are other circumstances which may also result in an automatic rejection of the loan application. HUD 4155.1 Chapter Four, Section A has a heading titled, “Mandatory Rejection of a Borrower” and states:

“A borrower is not eligible to participate in FHA-insured mortgage transactions if he/she is suspended, debarred, or otherwise excluded from participating in HUD programs. A lender must reject a borrower from participation if the borrower is on the

• HUD Limited Denial of Participation (LDP) list

• U.S. General Services Administration (GSA) List of Parties Excluded from Federal Procurement or Non-procurement Programs, and/or

• HUD’s Credit Alert Interactive Voice Response System (CAIVRS), (unless an exception exists as noted in HUD rules)

A borrower must also be rejected if he/she is presently delinquent on any Federal debt or has a lien placed against his/her property for a debt owed to the United States Government.”

Additionally, FHA loan rules state, “A mortgage loan application is not eligible for FHA mortgage insurance if the name of any of the following parties to the mortgage transaction is found on HUD’s LDP list or the GSA List:

• borrower

• seller

• listing or selling real estate agent, or loan officer.”

So the borrower isn’t the only person who might have an affect on the FHA mortgage in such cases–the seller, agent or lender may also be a factor if the above conditions mentioned apply. For more information on these rules, contact the FHA directly.

Do you have questions about FHA loans? Ask us in the comments section.