March 14, 2012

When the FHA and HUD recently announced a reduction in mortgage insurance premiums for streamline refinancing loans, there was also a reminder of a pending increase to other mortgage insurance premiums.

In late 2011, an act was signed into law which results in an increase in annual FHA mortgage insurance premiums for non-streamline FHA loans.

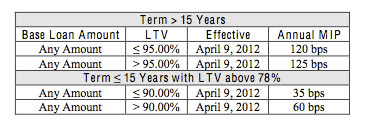

According to FHA Mortgagee Letter 12-4, “On December 23, 2011, the President signed into law the Temporary Payroll Tax Cut Continuation Act of 2011 (Public Law 112-78), which requires FHA to increase the Annual MIP it collects by 10 basis points”. This change is for FHA loans with case numbers assigned on or after April 9, 2012. Borrowers who get FHA loan case numbers before this date would pay the mortgage insurance premiums current for their type of FHA loan transaction.

Borrowers with FHA loans that meet certain conditions are still exempt from paying annual FHA mortgage insurance premiums. What are those conditions? According to the FHA;

“…forward mortgages with amortization terms of 15 years or less, and a loan-to-value (LTV) ratio of 78 percent or less” will remain exempt from the Annual MIP.

FHA loan applicants naturally want to know how much mortgage insurance they will be required to pay for FHA insured home loans on or after April 9, 2012. Here is the table, which shows the new amounts:

Borrowers should know these amounts are calculated against the loan amount, so there is no flat fee or figure we can provide to give an idea of how much you would pay in FHA mortgage insurance premiums under the new changes. Consult with your lender to get a calculation on your estimated annual premium based on your specific FHA loan amount.

Borrowers should know these amounts are calculated against the loan amount, so there is no flat fee or figure we can provide to give an idea of how much you would pay in FHA mortgage insurance premiums under the new changes. Consult with your lender to get a calculation on your estimated annual premium based on your specific FHA loan amount.