December 12, 2013

Recently we covered the FHA and HUD’s press release announcing changes in FHA loan limit policies. FHA loan limits have been changed in accordance with laws passed in 2008, which did not become effective until this year with regard to FHA loan limits.

Recently we covered the FHA and HUD’s press release announcing changes in FHA loan limit policies. FHA loan limits have been changed in accordance with laws passed in 2008, which did not become effective until this year with regard to FHA loan limits.

At the same time the FHA issued the press release announcing the changes, it also published a mortgagee letter describing the 2014 “floor” and “ceiling” for low-cost areas and high-cost housing markets, respectively.

According to FHA Mortgagee Letter 2013-43, “The minimum FHA national loan limit “floor” is at 65 percent of the national conforming loan limit (which is $417,000 for a one unit property for the period January 1, 2014 through December 31, 2014). The “floor” applies to those areas where 115 percent of the median home price is less than 65 percent of the national conforming loan limit.”

These published guidelines explain how the FHA and HUD define the terms “floor” and “ceiling”. If you have never purchased a home before, or have never applied for an FHA mortgage loan, it’s important to understand these definitions. According to the mortgagee letter, “Any area where the loan limit exceeds the “floor” is a high cost area. The maximum FHA national loan limit “ceiling” is at 150 percent of the national conforming loan limit. In areas where 115 percent of the median home price (of the highest cost county) exceeds 150 percent of the conforming loan limit, the FHA loan limits remain at 150 percent of the conforming loan limit.”

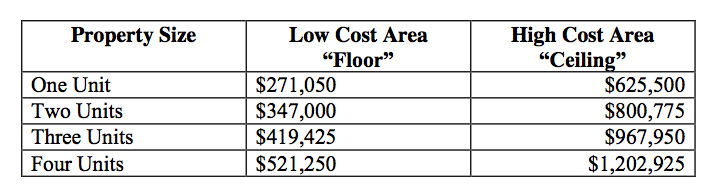

The mortgagee letter published a table, reprinted below, showing FHA loan limits for low cost and high cost areas.

The mortgagee letter also addresses the issue of loan limits for any other area aside from low-cost and high-cost:

“FHA loan limits for all other areas, where 115 percent of the median home price for the area is between the “floor” and “ceiling,” the loan limit shall be set at 115 percent of the median home price as determined by HUD.” You can learn more from the FHA mortgagee letter, which is a downloadable .pdf.

Do you have questions about FHA home loans? Ask us in the comments section. You can apply or get pre-approved for an FHA loan at www.FHA.com, a private company and not a government website.