April 29, 2013

The deadline for a new FHA mortgage insurance premium policy is approaching; beginning on June 3, 2013 most FHA loans endorsed on or after that date will be affected by the following changes as described in FHA Mortgagee Letter 2013-04:

“For loans with FHA case numbers assigned on or after June 3, 2013, FHA will collect the annual MIP for the maximum duration permitted under statute.”

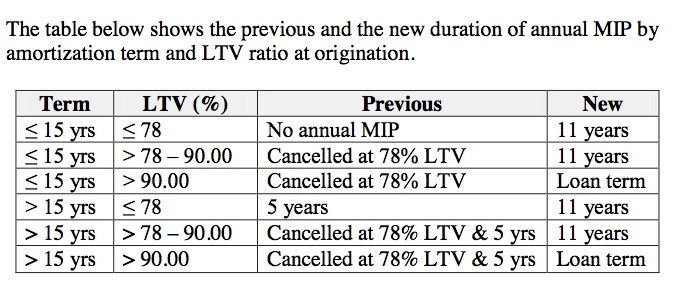

That basically means that many affected FHA loans will feature annual MIP for the duration of the loan rather than cancelling the MIP after a certain point. Other FHA loans will have MIP where there was none required previously.

Additionally, Mortgagee Letter 2013-04 states, “For all mortgages regardless of their amortization terms, any mortgage involving an original principal obligation (excluding financed Up-Front MIP (UFMIP)) less than or equal to 90 percent LTV, the annual MIP will be assessed until the end of the mortgage term or for the first 11 years of the mortgage term, whichever occurs first.”

Also, “For any mortgage involving an original principal obligation (excluding financed UFMIP) with an LTV greater than 90 percent, FHA will assess the annual MIP until the end of the mortgage term or for the first 30 years of the term, whichever occurs first.”

Here is a table reprinted from the FHA official site, which shows the affected loans and how the new MIP structure affects those loans with case numbers assigned on or after June 3 2013:

If you have questions about FHA MIP, speak with a loan officer or contact the FHA directly for further assistance.

Do you have questions about FHA home loans or refinance loans? Ask us in the comments section.