October 26, 2012

FHA loans are sometimes misunderstood–some people think FHA mortgages are only for low-income families, others wrongly assume only first-time home buyers can qualify for an FHA loan.

The FHA does provide a list of guidelines that list who is eligible–and who is not–to apply for an FHA mortgage or refinance. The FHA loan rules include guidelines on credit scores and minimum age–which we discuss below.

The rulebook that describes these things is called HUD 4155.1. In this guideline you’ll find the following:

“FHA insures mortgages made to individuals with valid Social Security numbers (SSN), and under the conditions described in this section, to state and local government agencies, and approved nonprofit organizations. Note: Employees of the World Bank, foreign embassies, etc., may not be required to have an SSN. Conclusive evidence of this exception must be provided.”

FHA rules also specifically address a common question about age limits. “There is no maximum age limit for a borrower. The minimum age is the age for which a mortgage note can be legally enforced in the state, or other jurisdiction, where the property is located.”

Another section of the rulebook, titled, ” Determination of Credit Worthiness and Minimum Credit Score Requirements” lists the requirements for borrowers, co-borrowers, and co-signers. It instructs the lender, “When determining the creditworthiness of borrowers, coborrowers, or cosigners, the underwriter considers their

- income

- assets

- liabilities, and

- credit histories.”

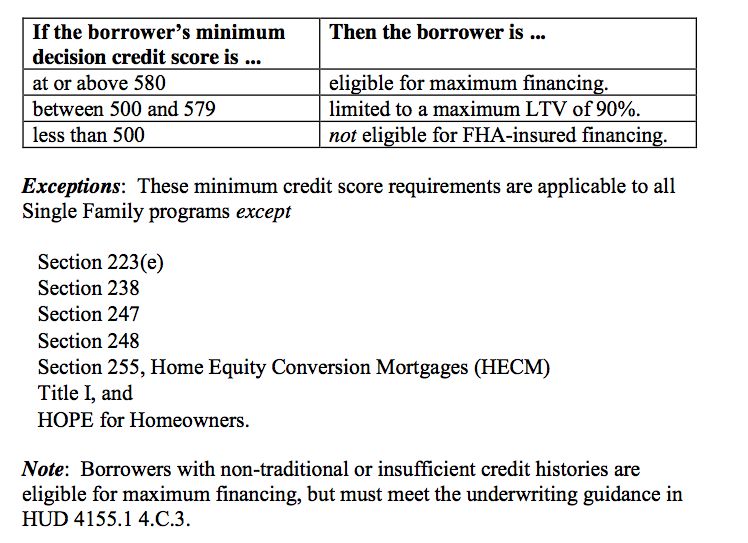

FHA Loan minimum credit scores are described in this table taken from HUD 4155.1:

The FHA minimum credit requirements are a very important part of the loan approval process. If you are concerned about your credit score and are considering an FHA mortgage loan, call the FHA at 1-800 CALL FHA and ask for a referral to a housing counselor who can help explain what needs to be done to prepare for a loan application including credit issues and how to request copies of your credit report.

Do you have questions about FHA home loans? Ask us in the comments section.