August 4, 2023

“Is my credit score good enough to get a mortgage?” That is among the most common questions about FHA loans and it’s easy to understand why. In times of high interest rates and competitive housing markets, every advantage counts.

Do borrowers with lower credit scores still have a shot at getting a home loan?

FHA loan rules for single-family home loans technically permit FHA loan approval for borrowers with FICO scores above 500.

If your credit scores are within the 500-579 range you may be asked to make a higher down payment. But if your FICO scores are 580 or higher you qualify by FHA standards for the lowest 3.5% down payment.

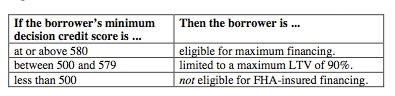

Here is the official FHA loan FICO score table from the FHA official site which lists the FICO score requirements.

One important thing to take note of here? There is no mention of the lender’s standards. And rightfully so, as every lender may have a different set of requirements. The bottom line?

FHA loan standards aren’t the only ones that may affect the approval or denial of a loan application. Lender standards also have a great deal to do with approval or denial of an FHA loan.

Many FHA loan applicants, when shopping around for a lender, discover that FICO score requirements at certain financial institutions are at a minimum 640 or better.

Some may require 620 or better. Shopping around for a lender is a very good idea.

And remember, just because the FHA loan FICO score requirements are as low as 500 or above doesn’t mean the lender will agree to extend credit to borrowers with those scores.

That’s why it’s a good idea to shop around for a loan and find a lender who may be willing to work with you and your circumstances.

Borrowers who are concerned about their ability to get approved for an FHA mortgage loan due to FICO scores or other issues should contact the FHA directly by calling them at 1-800 CALL FHA and requesting a referral to a HUD-approved housing counselor in the borrower’s local area.