March 23, 2015

We get many questions and comments about FHA home loans where FICO scores are concerned. Some borrowers seem to have doubts about whether or not they can qualify for an FHA mortgage loan or refinance loan because of their FICO scores and other financial qualifications. Consider this recent reader comment that came in:

We get many questions and comments about FHA home loans where FICO scores are concerned. Some borrowers seem to have doubts about whether or not they can qualify for an FHA mortgage loan or refinance loan because of their FICO scores and other financial qualifications. Consider this recent reader comment that came in:

“Have a score of 565 & trying to Get A Home Loan.”

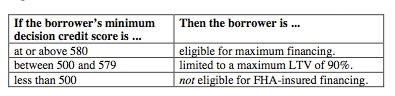

While there’s no specific question mentioned, it’s easy to see the reader is looking for some kind of information on FHA loan FICO score minimum requirements. Here’s a chart that’s printed in HUD 4155.1 which lays out the minimum required FICO scores needed to get an FHA mortgage:

Some who are new to applying for a home loan may wonder what it means to be eligible or ineligible for maximum financing. What this means is that borrowers who have a qualifying FICO score of 580 or higher are technically eligible for maximum financing under the FHA loan program.

That means that the borrower is eligible for the full amount of the asking price or appraised value of the home and any associated loan fees or expenses permitted to be included in the loan amount–and this is the important part–AFTER the borrower has made a minimum required down payment of 3.5%.

Borrowers who are not eligible for the full amount because their FICO scores are between 500 and 579 must pay ten percent down or more depending on the lender.

It should be pointed out that these are FHA minimum standards only–your lender may have higher standards depending on the situation, and this is acceptable under the FHA loan program.

Do you have questions about FHA loans? Ask us in the comments section.