January 22, 2015

A reader asks, “We r trying to buy a new double wide and property combo. But our credit scores are 582 & 533. The place where we are getting the house thru said it probly wouldn’t be a problem to get the loan. What do u think?”

A reader asks, “We r trying to buy a new double wide and property combo. But our credit scores are 582 & 533. The place where we are getting the house thru said it probly wouldn’t be a problem to get the loan. What do u think?”

The answer to this question is fairly simple. When a borrower’s FICO scores are within the FHA minimums for maximum financing, it’s then the lender’s decision to approve or deny the loan based on the lending standards of that financial institution.

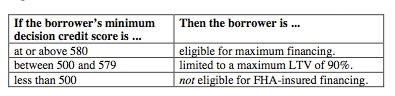

Let’s examine the FHA FICO score minimum chart as published in HUD 4155.1 and on the FHA official site:

That’s an exact reproduction of the chart found in HUD 4155.1. As you can see, one borrower’s credit score is within the FHA loan FICO standards for maximum financing, the other is not. In this case it is entirely possible that the lender might require a higher down payment due to one co-borrower’s FICO scores. In this case the borrowers should discuss the situation with the lender to see what might be required.

That’s an exact reproduction of the chart found in HUD 4155.1. As you can see, one borrower’s credit score is within the FHA loan FICO standards for maximum financing, the other is not. In this case it is entirely possible that the lender might require a higher down payment due to one co-borrower’s FICO scores. In this case the borrowers should discuss the situation with the lender to see what might be required.

When the FICO scores are within FHA standards for maximum financing, the lender can approve the loan. However, many lenders have higher FICO score requirements than the FHA minimums, and this is permitted under FHA loan rules. It’s not uncommon, it’s not against the rules, and borrowers should definitely take care to find out what FICO score requirements a given lender has for maximum financing.

Do you have questions about FHA home loans? Ask us in the comments section.