August 7, 2013

FHA mortgage insurance rules changed earlier this year–there were a variety of alterations that included a “lifetime of the loan” mortgage insurance premium requirement. Starting in June of 2013, all FHA with case numbers assigned on or after June 3 will be charged annual mortgage insurance premiums “for the maximum duration permitted under statute.”

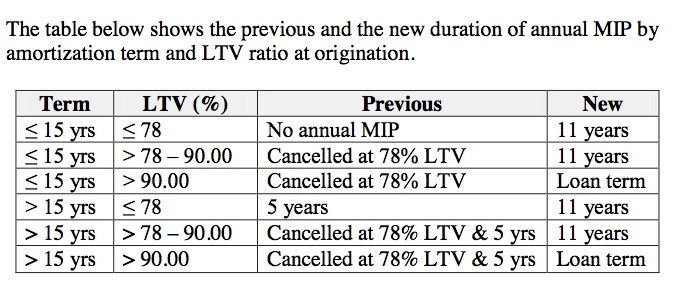

In FHA Mortgagee Letter 2013-04, the new rules state, “For all mortgages regardless of their amortization terms, any mortgage involving an original principal obligation (excluding financed Up-Front MIP (UFMIP)) less than or equal to 90 percent LTV, the annual MIP will be assessed until the end of the mortgage term or for the first 11 years of the mortgage term, whichever occurs first.”

Additionally, “For any mortgage involving an original principal obligation (excluding financed UFMIP) with an LTV greater than 90 percent, FHA will assess the annual MIP until the end of the mortgage term or for the first 30 years of the term, whichever occurs first.”

The mortgagee letter also notes, that FHA calculates the loan-to-value ratio, “as a percentage by dividing the loan amount (prior to the financing of any UFMIP) by the lesser of the purchase price (if applicable) or the appraised value of the home. For streamline refinances without appraisals, FHA uses the original appraised value of the property to calculate the LTV.”

There were some borrowers who were hoping to beat the new rules by getting their loans case numbers before the deadline. Now that the deadline has passed the following FHA MIP table applies to these loans as printed in FHA Mortgagee Letter 2013-04. Note that the table shows both the “old” MIP cancellation policy AND the new requirement.

Do you have questions about FHA home loans? Ask us in the comments section.