June 27, 2013

A reader asks, “Hello, my husband score is 623 and my score is 738, is there a FHA loan out there that would allow us to get a loan? I have read that some companies have stated that both parties must have at least a 650 or above.”

A reader asks, “Hello, my husband score is 623 and my score is 738, is there a FHA loan out there that would allow us to get a loan? I have read that some companies have stated that both parties must have at least a 650 or above.”

Credit score questions are some of the most frequently asked when it comes to a new purchase FHA home loan. While it’s true that the FHA does have a set of minimum FICO scores listed (see below) there is one very important thing ALL borrowers should know about the FHA loan rules for minimum credit scores–they are the FHA’s minimums ONLY.

A lender is free to require higher credit scores as long as such higher standards are consistently applied and in accordance with the Fair Housing Act.

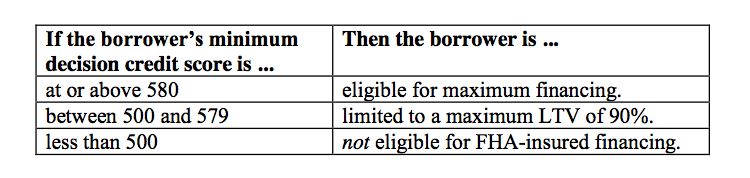

What are the FHA minimum credit score or FICO score standards? This table gives us the details that are effective at the time of this writing:

The reader asks about scores ranging from between 623 and 738. According to the table above, these scores would meet FHA loan standards for maximum financing. However, an individual lender may require both parties to have at least a 640 FICO score as the lowest one–but not all lenders have the same standards.

The reader asks about scores ranging from between 623 and 738. According to the table above, these scores would meet FHA loan standards for maximum financing. However, an individual lender may require both parties to have at least a 640 FICO score as the lowest one–but not all lenders have the same standards.

That is an important aspect of FHA home loans any borrower should pay attention to–you may need to comparison shop between lenders for the best rates and terms. One lender may be willing to work with a borrower or borrowers in the circumstances described in the reader question, others may not be. FHA minimums cannot overrule the lender’s standards in this area.

Borrowers who want advice on how to improve their creditworthiness for an FHA mortgage loan should contact the FHA directly at 1-800 CALL FHA and ask for a referral to an FHA/HUD approved housing counselor.

Do you have questions about FHA home loans? Ask us in the comments section.