June 3, 2013

We’ve gotten a lot of reader questions lately about FHA loan standards for credit, FICO scores and more. Many readers want to know what the FHA FICO score requirements are and whether their credit reports are good enough to qualify for an FHA mortgage.

There are two important things to understand about FHA loan credit requirements. The FHA loan rules spell out the minimum FICO scores required by the FHA; those minimums are found in HUD 4155.1 Chapter Four, Section A.

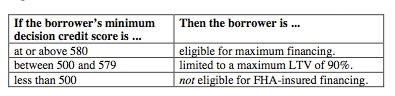

According to the FHA, “The table below describes the relationship between the borrower’s minimum credit score and the maximum loan-to-value (LTV) ratio for which he/she is eligible.”

The FHA minimum for maximum financing is listed in the table above at 580. But many borrowers don’t understand that the FHA scores shown here are not necessarily the ones a lender may require. The lender’s FICO standards can be–and often are–higher than FHA minimums.

The lender is not outside the rules by requiring a higher FICO score as long as that requirement is applied consistently and according to Fair Housing Act laws.

Additionally, it should be noted that the FHA minimums shown here do not apply to ALL FHA home loan programs. HUD 4155.1 Chapter Four lists some programs that have exceptions to the numbers shown above.

“These minimum credit score requirements are applicable to all Single Family programs except

• Section 223(e)

• Section 238

• Section 247

• Section 248

• Section 255, Home Equity Conversion Mortgages (HECM)

• Title I, and

• HOPE for Homeowners.”

Again, the lender may or may not have the same FICO requirements as the FHA–it’s best to check with several lenders, comparison shop for the best rates, and make sure you know what your FICO scores are going into the FHA loan application process.

Do you have questions about FHA home loans? Ask us in the comments section.