April 2, 2013

Effective on 1 April 2013, the FHA changed its mortgage insurance premium rules. We’ve discussed this at length in other blog posts, but now that the date has come and gone for the changes to take effect, it seems like a good time to review those changes.

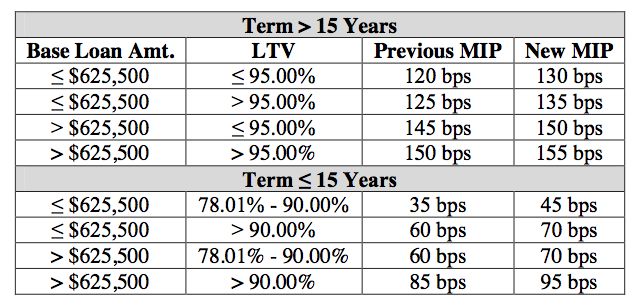

According to FHA mortgagee letter 2013-04, ““FHA will increase its annual mortgage insurance premium (MIP) for most new mortgages by 10 basis points or by 0.10 percent.” FHA MIP for Jumbo Loans is also going up. An FHA Jumbo Loan is basically described as mortgages at $625,500 or more. The increase on these loans is “5 basis points or 0.05 percent, to the maximum authorized annual mortgage insurance premium.”

These MIP increases exclude “certain streamline refinance transactions.”

The FHA describes these changes in Mortgagee Letter 2013-04 a follows:

“Under Public Law 111-229(1)(b), FHA may adjust its mortgage insurance premium rates, as measured in basis points (bps), by Mortgagee Letter. The first table shows the previous and the new annual MIP rates by amortization term, base loan amount and LTV ratio. All MIPs in this table are effective for case numbers assigned on or after April 1, 2013.”

Here is that table, as found on the FHA official site:

For more information on these changes and how they affect FHA loans with case numbers assigned on or after April 1 2013, speak to a loan officer or contact the FHA directly at 1-800 CALL FHA.

Do you have questions about FHA loans or how FHA refinance loans work? Ask us in the comments section.