October 12, 2012

A not-so-commonly asked question, but a very important one about FHA loan rules, involves the use of a power of attorney to apply for or commit to an FHA mortgage loan.

FHA loan rules state, “All borrowers applying for the mortgage and assuming responsibility for the debt must sign Fannie Mae Form 1003, Uniform Residential Loan Application (URLA), and all addenda.”

“Either the initial loan application or the final, if one is used, must contain the signatures of all borrowers. The initial loan application may not be executed by power of attorney except for military personnel and incapacitated borrowers…”

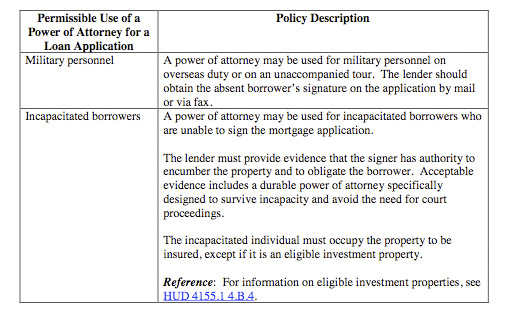

What does this mean? In short, there are only two types of FHA borrowers permitted to have a loan executed on their behalf by a power of attorney; the FHA official site has a chart describing the circumstances under which a borrower is permitted to get an FHA loan via a power of attorney–both military members and incapacitated borrowers have requirements which must be met in order to get the loan approved:

Power of attorney rules and regulations may be affected by state law–FHA loan rules don’t carry a comprehensive list of such laws so a borrower with questions should contact a legal expert in his or her state to learn more about how such regulations may affect a power of attorney transaction for an FHA mortgage.

Do you have questions about FHA loans? Ask us in the comments section.